“So what do you do?” the man sitting next to me asked.

“Right now, I am pursuing to be a professional day trader,” I replied.

“Oh.” He paused. “What is that? I have no idea what that means.”

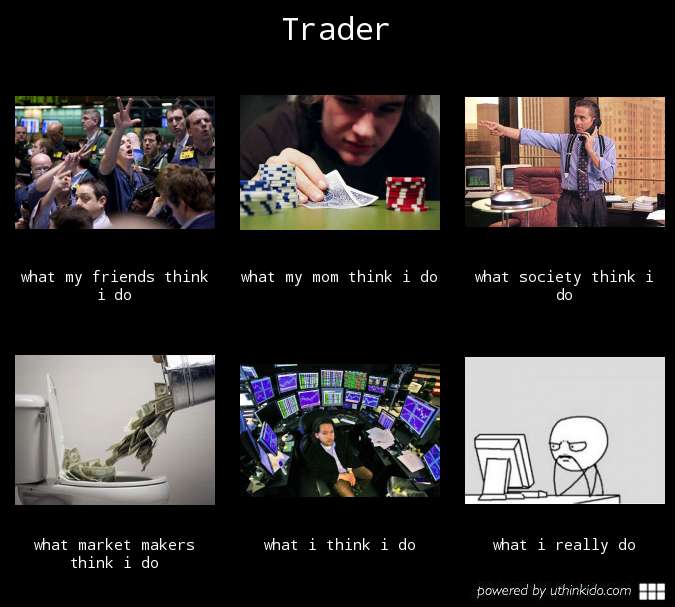

Over the past year, I have shared with people that I am pursuing day trading. It is interesting how this profession elicits so many different reactions.

- “Oh, you better be careful!”

- “So… you like to gamble?”

- “Isn’t that risky?”

- “I know a friend who does that. It seems very challenging.”

- “What stocks are you buying?”

Before I had any idea of trading, I had similar perceptions of what it looked like as a profession.

This is a story about my journey in becoming a professional day trader.

To the moon

I bought my first bitcoin in 2017. It was right before the huge pump. But I sold it all after I saw the price dip down below my entry. I didn’t know it at the time, but this was my first lesson about the emotional and psychological aspect of trading.

I was never prone to FOMO. But I had some major FOMO, because of what I could have made in such a short time. I experienced the fear of losing money when price dipped below my entry. My risk tolerance was zero. I only accepted a linear line up. Once price started to dip, I felt that I would lose so I had to get out. Right before that, I saw my money increase 30%. I was elated about how easy it was to see money grow.

During this time, I dabbled with signal channels in Telegram, automated trading bots, and some studying. I read Trading in the Zone by Mark Douglas. This book was foundational in understanding some of the basic fundamentals of how individuals and institutions (collective individuals) approach the markets.

All that to say, trading was a fun hobby. I was a full-time student and became a dad during this season. It was risky enough to put some of our savings into bitcoin and hope for the moon.

“I don’t do this for fun”

Fast forward about five years, I was working as a freelance content specialist, a title I designed for myself. I had the opportunity to work with a financial firm that wanted to make a website for its new cryptocurrency trading platform. It was a great collaboration and the website went live.

A few months later, I was contacted again to create content that would serve as a testimonial to attract new customers. I had the opportunity to interview professional and active traders. It was enlightening to learn first-hand accounts about people’s experience with trading. I created a landing page that documented a trader’s journey that would have intrigued potential users to test and try the trading platform.

When I asked about a trader’s experience and needs for a trading platform, I distinctly remember one of the interviewee’s responses. “I don’t do this for fun.” It was a serious business, a serious profession, to be a trader. I only thought it was a hobby for the elite or some foolish college kid who wanted to make YouTube videos.

Ironically, this content was never published. Unfortunately, I was also never paid for my services. I could have pursued this more diligently, but my curiosity about trading was ignited.

Back to school

After graduating with my second advanced degree that I would not use professionally, I vowed I would never go back to school. Perhaps I am addicted to learning. I began my professional trading studies in 2023. I also began renovating my unfinished basement. My wife was pregnant with our second daughter. It was quite the year.

I started a one-year learning mentorship. Fortunately, there was a 2x speed setting and I was pretty good at keeping up with the content. The professional training started in the summer when I began back testing the data. I expedited this process because I wanted to provide financial stability for my family. Ironically, the means was through a profession that was perceived to be the riskiest.

Looking back at my studies and training, it has been a lot.

Books (related to money or trading)

- Rich Dad, Poor Dad, Robert Kiyosaki

- Trading in the Zone, Mark Douglas (2019)

- The Little Book that Beats the Market, Joel Greenblatt

- Shareholder Yield, Meb Faber

- The 501-k Plan, Palm Beach Research Group

- Think and Grow Rich, Napoleon Hill

- Blockchain Revolution, Don Tapscott

- Trading and Exchanges, Larry Harris

- The Psychology of Money, Morgan Housel

- The New Trading for a Living, Dr. Alexander Elder

Courses, Newsletters, Videos

- Babypips, School of Pipsology

- ICT 2022 Mentorship

- Money Matters, Clive Lim

- Dividend Stocks Rocks

- Palm Beach Group

- Cryptovince Education

- Jim Rohn

Experience

- Torque Trading

- Personal investments

- Investing and managing accounts for family

After all the studies and accumulation of experiences, I went live in September 2023.

43% gain was the worst thing that happened to me

I funded my first trading account with $10,000. It was an amount that would provide sufficient capital to trade micro futures. It was also an amount that if I were to bust, it would not be super detrimental to our family. This was the LEAN model of day trading. I was the entrepreneur and I was the user, collecting data about myself.

When you first start trading with real money, there is a clear mental and emotional shift. I think it’s similar to playing poker with chips versus real money. When there is real money involved, you take things more seriously. There is more excitement. You don’t just want to win, you want to see the numbers grow. And when it doesn’t, it hurts a lot more. It’s easier to push a stack of chips all in with play money. It’s a lot harder to do it when you have $10,000 on the line.

The first few months were a roller coaster of a ride. Below are real numbers:

| Month | Account Value | MTM Performance |

| September | $8,400 | -16% |

| October | $12,012 | +43% |

| November | $7,928 | -34% |

| December | – | Holiday Travel |

| January-February | – | Steady negative |

| March | $4,517.02 |

The first month of trading was fun and exciting. I was able to finally put real money behind three months of studying and practicing. Despite having a drawdown, I knew I had the technical skills to be successful.

The next month was probably the worst thing that happened to me. I was extremely successful with a 43% gain. I was elated that the “system” worked. I made $4,000 in a month, probably working 20 hours or so. That’s about $200 per hour, more than four times what I made as clinical editor with a doctorate degree. I hit the jackpot. I was going to be a millionaire. I was going to provide for my family especially with our second child being born.

Little did I know how detrimental this monetary gain would become. The next month, I was confident and ready to put the trading system back to work. I wanted to duplicate the returns. However, I was down 34%, worse than where I started. December was a blessing and curse because we took time to travel for the holidays. I put my trading on hold and focused on more important things like my family. It was a blessing because I was forced to step away from trading. It was a curse because after my travels, the dark seed that had been planted in October was never uprooted.

January and February 2024 were rough months because I was separated from my family. It was rough months because my trading account kept going down. Once they returned and the fog cleared, the damage was done. I was down 54.8% from my initial $10,000.

I am a consistently, successful trader

It would have been easy to throw in the towel at this point. Or I could have done some revenge trading and over leverage the account, trying to go all in to double up the money. Instead, my practice and studies proved beneficial. I remembered that trading is a difficult process and journey. I remembered that you can be successful with smaller accounts. I remembered that 90% of people who pursue trading fail. I never liked being similar to everyone else. This time was no different.

With the $4,500 left in my account, I vowed to myself that I would not consider myself a professional trader, unless I was profitable three months in a row. My goal was to make 20% each month. I shifted my focus to trade with the least number of contracts, focusing on the 1% risk that was part of my original trading system. This was not fun or sexy. There was nothing to boast about. One percent risk was $45. A 20% return was $900. Decent money, but nothing close to the swimming in money meme you have of professional day traders, driving around in Lamborghinis.

Slowly, but surely, I stuck to my trading system and focused on my goal.

| Month | Account Value | MTM Performance |

| September | $8,400 | -16% |

| October | $12,012 | 43% |

| November | $7,928 | -34% |

| December | – | Holiday Travel |

| January-February | $4,517.02 | Steady negative |

| March | $4,196.89 | -7.1% |

| April | $5,154.97 | 22.83% |

| May | $6,274.50 | 21.72% |

| June | $7,406.57 | 18.04% |

One note, I arbitrarily picked 20% as a goal. Taking a 3R trade (i.e., a 3 risk to reward ratio) is considered a good trade. I thought doing two 3R trades a week, would amount to 24R a month, allowing for 4% risk to be wrong.

I am a professional trader

I achieved my three-month goal. I now considered myself a professional trader. In July 2024, I allocated a larger sum of money to trade. I vowed not to make the same mistakes when I had the massive drawdown. I just needed to keep trading the same way I did and I would make 20% monthly returns.

It seems that every time there is a string of success, the downturn eventually follows. It seems that at every major transition, there is usually a downturn, too.

The next six months was another roller coaster ride. Despite ending negative for the year, I was still determined to stick with my profession. Like opening any new business, it is hard to be profitable the first year.

I documented the lessons I learned from 2024.

Philosophy

- Before looking at any chart, start with the right mental preparation

- Do you want to work overtime?

- Time benefit analysis

- Is this part of my goal of making consistent income? Or is it something else such as the need to be right?”

- Professional trading is like weight lifting

- Show up every day, stick to the plan, and you will get results

- If you do not stick to the plan, you will get hurt and it will set you back

- In order to be a consistently successful trader, I need to systematically take profits, and avoid trying to be perfect or trying to be right with my market analysis

- Emotions cloud judgment and analysis or market opportunities

- You can still be proud of your achievements such as proper risk management, taking systematic profits, growth as a trader

- Do not do other activities when you have positions open, especially ones that can heighten your emotions or take up additional mental bandwidth

- Be the casino

Macro

- Stop overtrading

- Commissions eat into profits and usually end up losing more

- Create strong passwords so your account does not get hacked

- Have the correct business strategy and stick to the goal

- Massive compounding verse consistent income generation

- Avoid trading after a big win or loss

- This prevents self-sabotage of trading from euphoria or fear

Technical

- Trade based on time

- Trade with momentum

- Account management

- Convert USD to CAD, then withdraw the CAD amount

Systematic Profit Taking

- Goal: $1000 per week

- Always close half the position between 2-3R

Significant lessons learned from practical application

- Keeping a journal and reviewing

- Proper mental practice

- Envisioning success

- Goal setting, keeps in the correct direction

- You don’t need perfection to be profitable

You don’t need perfection to be profitable

Currently, it is March 2025. I was consistently profitable the first two months of this year. In two weeks, I lost those gains. It is the same process, the same lessons.

Being a professional day trader is difficult. Despite my lack of making consistent income, I have gained significant personal growth. I have gained significant amount of time and flexibility. I am enjoying the process (on most days).

Luckily, I don’t need to be perfect to be profitable. And “whatever result I get is a perfect reflection of my level of development and what I need to learn.” (Trading in the Zone).

So, until my account goes bust, I guess I am a professional day trader.